How can we pay for Medicare for All? It’s actually easy – oh, except for the politics! Instead of paying premiums to commercial health insurers, we could finance a publicly administered plan with a combination of income sources that spread the costs evenly across all income levels and all large businesses. Check out how much we’ll actually need, plus these practical options to pay for Medicare for All.

—

1. Options to Finance Medicare for All

By Bernie Sanders. Undated.

The following “menu”, based on information taken from Bernie Sanders’ website, summarizes a wide variety of options for financing a national Medicare-for-All system.

—

2. The Economic Analysis of Medicare for All

By Political Economy Research Institute (UMass, Amherst). November 2018.

According to the analysis, the total cost of full, universal coverage under Medicare for All would be $2.93 trillion each year (see page 72) which is much less than the $3.24 trillion we are currently spending each year (see page 69).

Today our taxes already cover $1.88 trillion of the $2.93 trillion we would need. We would have to raise another $1.08 trillion (see page 72).

According to the authors:

Of course, these new tax revenues would not constitute a net additional cost or spending burden on the U.S. economy. These funds would rather be serving to substitute for the loss of revenue into the U.S. health care system that presently come from existing private revenue sources— i.e. primarily private health insurance and out-of-pocket expenditures. These private revenue sources would no longer operate.

They go on to detail a variety of options that could be combined to raise $1.08 trillion, including

- business contributions equal to what they’re currently paying for premiums minus 8%,

- a sales tax on non-necessities (exempting food, beverages, housing, utilities, education and nonprofits),

- a net worth tax with a $1 million exemption, and

- taxing long-term gains as ordinary income.

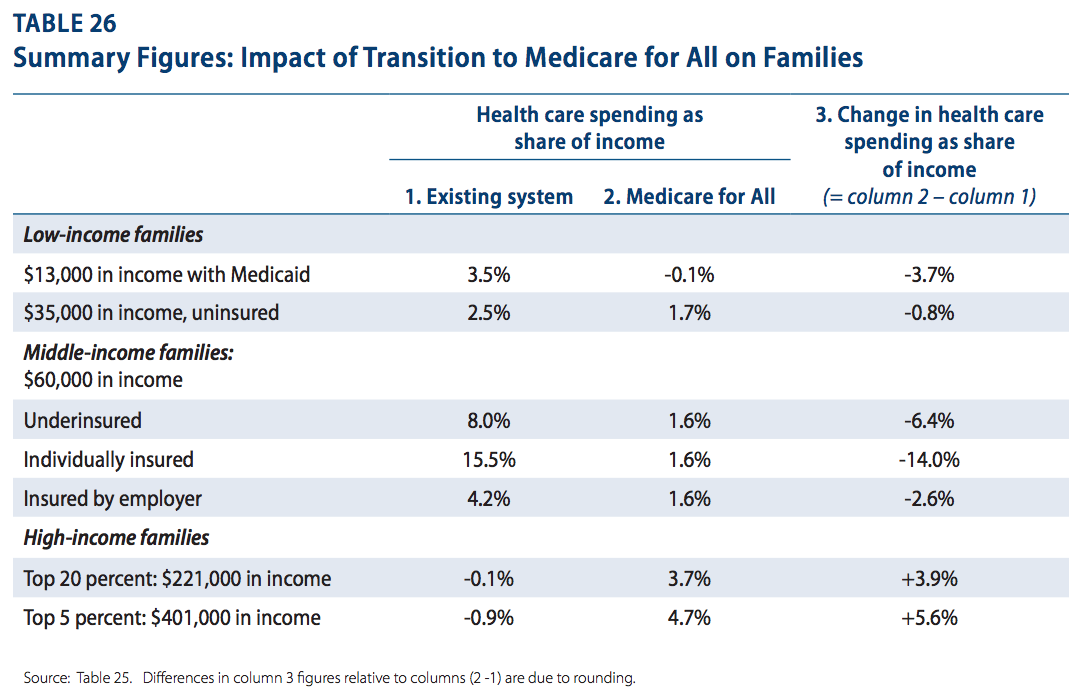

With this combination of financing strategies, only the very highest earners making more than $221,000 a year would end up paying a little more, while everyone else, including businesses, would save money as shown in the following table (see page 91).

—

3. A single-payer advocate answers the big question: How do we pay for it?

Excerpt. Vox.com. By

The first thing you want to do obviously is take the money flows we already have and divert them into the Medicare system. That is easier said than done.

I’ve been trying to think about how to do it in a way that’s also not regressive, by imposing substantially more cost on low-earners who currently receive Medicaid. Because that’s a criticism people will make. Any tax you use is going to make low earners pay more than they currently pay because they don’t pay anything.

My idea is to completely overhaul the whole payroll tax system in the US. The United States has three payroll taxes. Social Security, Medicare, and unemployment benefits. The way they work is unemployment insurance applies to people to the first $7,000 of earnings. Social Security applies to the first $125,000. Then Medicare applies to all earnings, plus you have the additional Medicare tax that pops in above $200,000.

It is a regressive structure. The first dollar of earnings is hit with the full unemployment tax, the full Social Security tax, the full Medicare tax. Then those taxes fall off until you’re left with the 2 percent Medicare tax at the high earnings.

So let’s squeeze all of those into flat taxes. Instead of charging, like we do with unemployment benefits, 6 percent on the first $7,000 of earnings, you can knock that down to less than 1 percent on all earnings. You can do that with Social Security as well. Knock that down and apply it to all earnings. Medicare would be unchanged.

That then opens up a lot of space in the low to mid-earners to apply a higher Medicare tax without there being a net tax increase. Because their unemployment tax has gone down substantially. Their Social Security tax has gone down substantially. Then you can do a flat Medicare tax and the net effect is it’s all falling on people making more than $100,000 a year.

—

4. Here’s How to Fund Medicare For All

By Kevin Drum, blogger at Mother Jones.

I’m sure that what I have to say isn’t new, but for some reason I’ve never come across it. Here it is: Fund M4A by taxing corporations.¹

The idea behind this is twofold. First off, you’re always better off if you don’t create new taxes on people. To the extent you can, a program is more politically palatable if it keeps the revenue streams that are already in place.

Second, taxing corporations is relatively invisible. Sure, economists will tell you that most of the tax eventually falls on individuals, but most people won’t realize it. This leaves Republicans trying to generate outrage among voters for a tax they’ll never have to pay directly. Good luck with that.

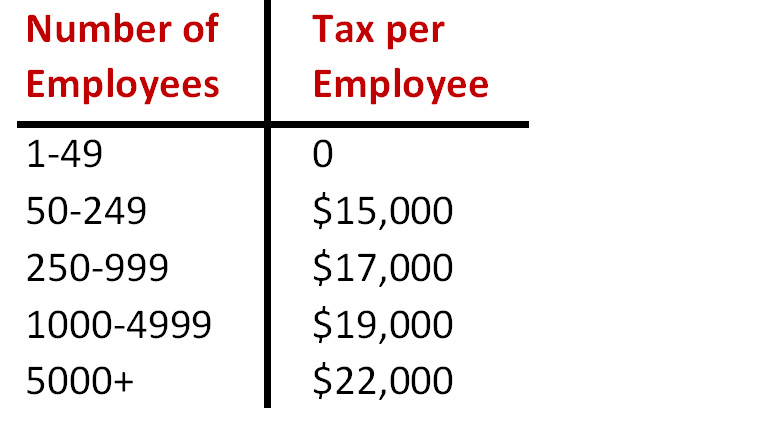

Now, the current revenue stream for private health care primarily consists of the premiums paid by corporations to provide coverage for their employees. To the best of our ability, then, we want to tax corporations so they’ll come out even: that is, their tax burden will go up but they’ll no longer have to pay health premiums. If this is a wash, then even opposition from corporations will be fairly muted. So why not levy a per-employee tax that rises moderately with the size of the corporation? For example:

This would work just like income tax: you’d pay the higher rate only on the employees above each cutoff. So if you had 50 employees, you’d pay $0 for the first 49 and $15,000 for the one employee above that.

—

HEAL California is an independent news and information hub focused on the California Medicare for All movement. We feature non-partisan news, views, podcasts and videos that highlight the continuing failures of our broken healthcare system and elevate the voices of advocates and organizations fighting for change.

Check out our Media page for experts and additional resources including links to legislation, studies, and more.

Keep up with the California Medicare for All movement –